Reverse Charge VAT might sound complicated and bureaucratic, but in reality, it makes life a lot easier if you want to sell your services to customers in other EU markets. In short, you can exclude the VAT from your invoices and forward the obligation of paying the correct VAT to the customer. Resulting in you not having to struggle with understanding complicated VAT regulations in other countries, or across border VAT returns.

EU’s reverse charge VAT – making life easier for you

The EU Reverse Charge VAT mechanism was implemented in 1993 to make the selling and buying of goods and services between the EU member states easier by simplifying the VAT reporting system. When a customer buys a consultant service from a vendor in another EU country, the Reverse Charge VAT mechanism moves the responsibility for ensuring correct VAT payment from the vendor to the buyer of this consultant service. This means that if you send invoices to customers based in another EU country, you invoice without VAT and leave it to the customer to pay the correct VAT in the country they are registered in.

No need to VAT register abroad

This reverse charge VAT agreement means that you as a seller of consultant services do not need to VAT register in the country where the supply is made since the buyer is obliged to ensure that correct VAT is paid. The buyer needs to be another business – if you sell your services to an individual, other rules apply and VAT needs to be added. If you as a supplier incur any local VAT on costs related to the service you supply under the Reverse Charge, you may recover them through an EU VAT reclaim.

Reverse VAT charge – a case example

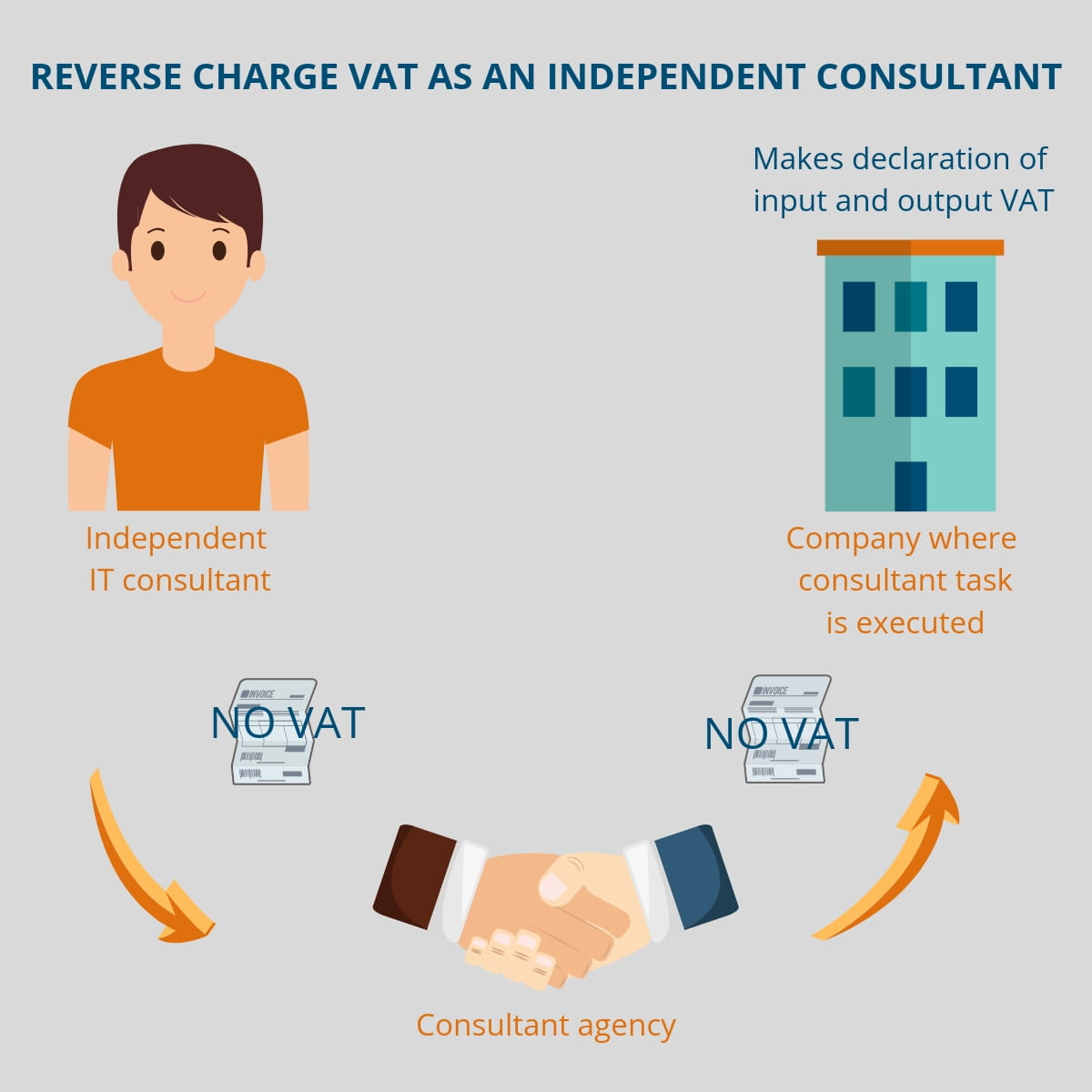

John Johnsen is an independent software developer in the UK. He has his own company John Johnsen Limited. John Johnsen finds an interesting consultant task at a Swedish company on Right People’s website and applies for the project. He gets the job and ends up on a 4 months project working full-time in Stockholm. Every month, John sends an invoice covering the actual working hours to Right People Groups Digital GmbH in Germany. He makes use of the reverse charge VAT agreement and leaves out the VAT in his invoice. Since Right People Group is not the end customer and actual recipient of the service, they don’t have to pay VAT either. Right People sends an invoice to the end-customer in Sweden charging them for the consultant’s work. This invoice also excludes VAT, but since the Swedish customer is the final recipient of the consultant’s service it is obliged to pay the appropriate statutory VAT in Sweden.

Reverse charge VAT from the perspective of customers and authorities

When the Reverse Charge VAT is applied, the buyer of your services declares both their purchase (called input VAT) AND their supplier’s sale (called output VAT) in their VAT return. Both entries cancel each other out from a cash payment perspective and equal zero. This allows the tax authorities to control the transactions as part of the returns for cross border supplies.

Reverse charge VAT invoice – what should it look like?

When you are invoicing a company in another EU country and want to make use of the reverse charge VAT agreement, you create a standard invoice and exclude the VAT. Adding a comment in the invoice stating that it is mandatory for the customer to ensure correct and timely payment of the statutory VAT in their country is advised to clarify that the responsibility lies with the recipient of the invoice. We have created a reverse VAT invoice template for a British consultant sending an invoice to a German client.

When it comes to the invoice itself, there are still slight differences in invoice requirements in EU member state but the following details should always be included when selling consultant services:

- Invoice Date

- An invoice number, unique and sequential

- Name and address of the supplier and the customer

- VAT number of the supplier

- A description of the service supplied, including quantities /e.g. hours worked

- The date/ period when the service was delivered

- The net amount of the service

- The EU VAT rate charged, the amount, and the gross charge

- Official foreign currency rate if this differs from the currency in your country

You can read more about the invoice requirements in the EU and the individual members states here.

The reverse charge VAT mechanism is, of course, a much more complex legal structure than what is described above and we are not legal experts, so if you want to know this subject in detail and know the exact rules in your country, you should consult a tax expert or the EU’s website.

Read more: Tax compliance when working abroad

While this blog post covers the reverse charge VAT, as a freelance consultant working in a country other than where your company is registered, it is your responsibility to ensure you adhere to local tax compliance laws. Read more about the subject on White November’s website.